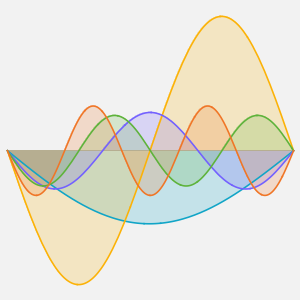

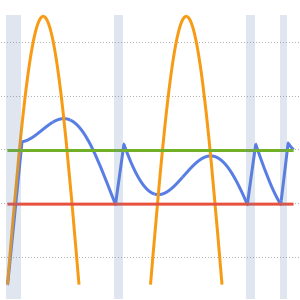

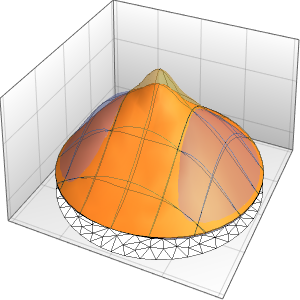

求欧式看涨期权的价值

当标的资产的价格和成交价都为 100 美元,无风险收益率为 6%,标的资产的波动率为 20%,久期为 1 年,使用布莱克-斯科尔斯公式,求欧式普通看涨期权的价值.

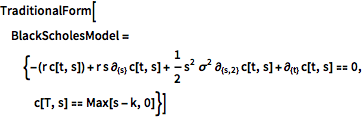

In[1]:=

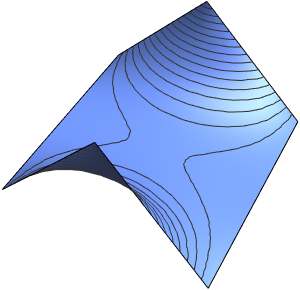

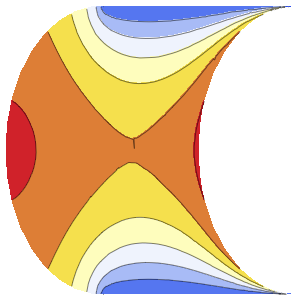

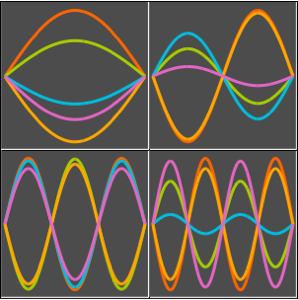

TraditionalForm[BlackScholesModel = {-(r c[t, s]) + r s \!\(

\*SubscriptBox[\(\[PartialD]\), \({s}\)]\(c[t, s]\)\) +

1/2 s^2 \[Sigma]^2 \!\(

\*SubscriptBox[\(\[PartialD]\), \({s, 2}\)]\(c[t, s]\)\) + \!\(

\*SubscriptBox[\(\[PartialD]\), \({t}\)]\(c[t, s]\)\) == 0,

c[T, s] == Max[s - k, 0]}]Out[1]//TraditionalForm=

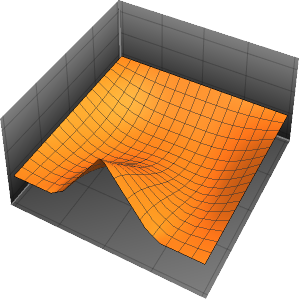

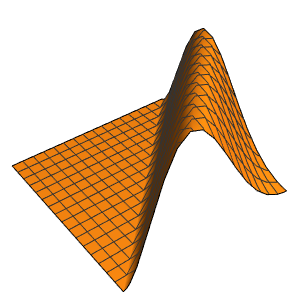

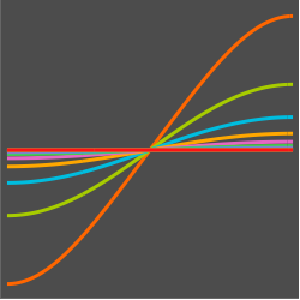

求解边界值问题.

In[2]:=

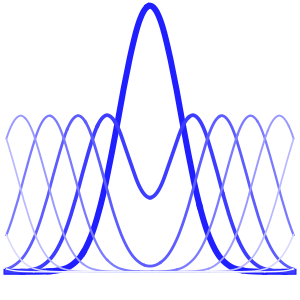

(dsol = c[t, s] /.

DSolve[BlackScholesModel, c[t, s], {t, s}][[

1]]) // TraditionalFormOut[2]//TraditionalForm=

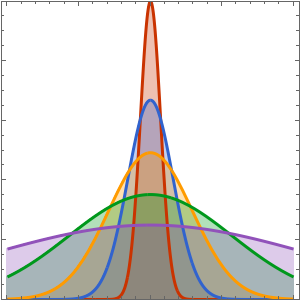

计算欧式普通期权的价值.

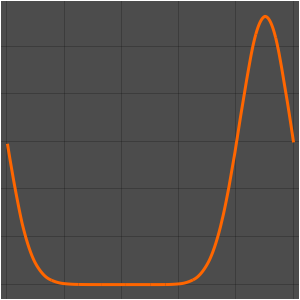

In[3]:=

dsol /. {t -> 0, s -> 100, k -> 100, \[Sigma] -> 0.2, T -> 1,

r -> 0.06}Out[3]=

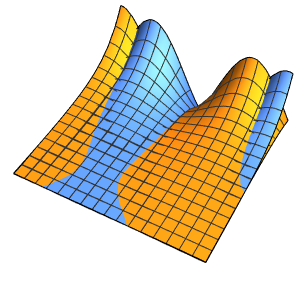

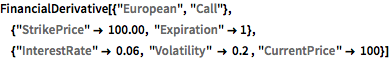

与 FinancialDerivative 给出的值比较.

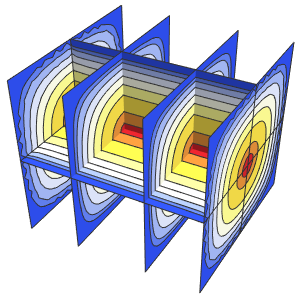

In[4]:=

FinancialDerivative[{"European", "Call"}, {"StrikePrice" -> 100.00,

"Expiration" -> 1}, {"InterestRate" -> 0.06, "Volatility" -> 0.2 ,

"CurrentPrice" -> 100}]Out[4]=