Find the Value of a European Call Option

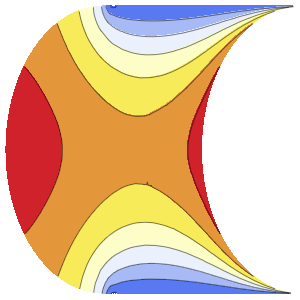

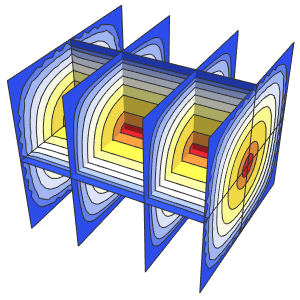

Find the value of a European vanilla call option if the underlying asset price and the strike price are both $100, the risk-free rate is 6%, the volatility of the underlying asset is 20%, and the maturity period is 1 year, using the Black–Scholes model.

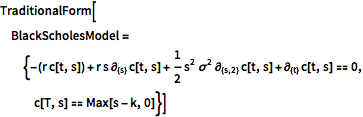

In[1]:=

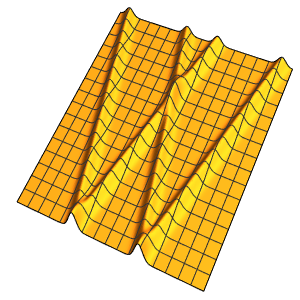

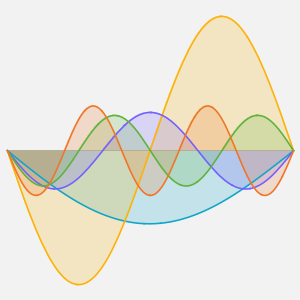

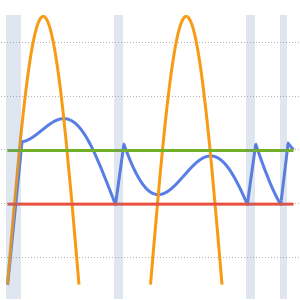

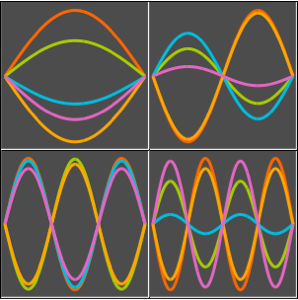

TraditionalForm[BlackScholesModel = {-(r c[t, s]) + r s \!\(

\*SubscriptBox[\(\[PartialD]\), \({s}\)]\(c[t, s]\)\) +

1/2 s^2 \[Sigma]^2 \!\(

\*SubscriptBox[\(\[PartialD]\), \({s, 2}\)]\(c[t, s]\)\) + \!\(

\*SubscriptBox[\(\[PartialD]\), \({t}\)]\(c[t, s]\)\) == 0,

c[T, s] == Max[s - k, 0]}]Out[1]//TraditionalForm=

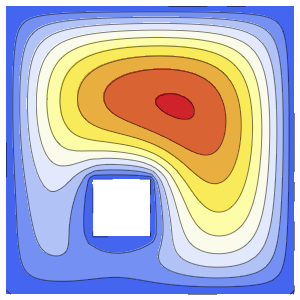

Solve the boundary value problem.

In[2]:=

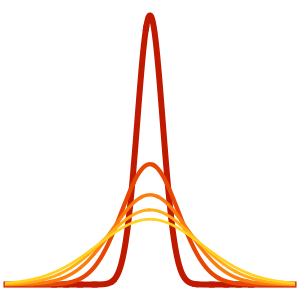

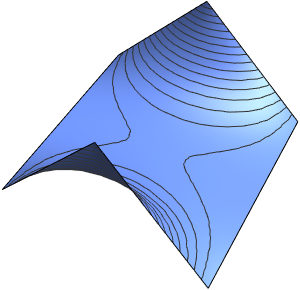

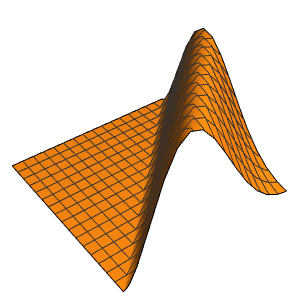

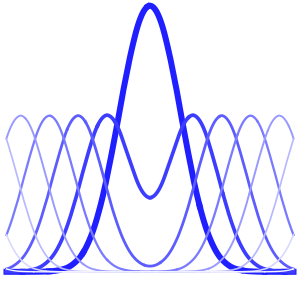

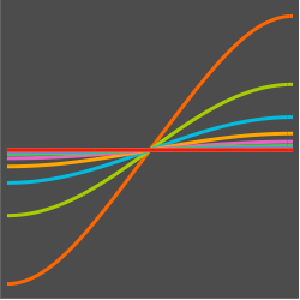

(dsol = c[t, s] /.

DSolve[BlackScholesModel, c[t, s], {t, s}][[

1]]) // TraditionalFormOut[2]//TraditionalForm=

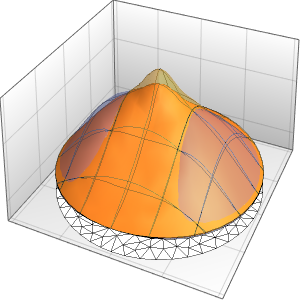

Compute the value of the European vanilla option.

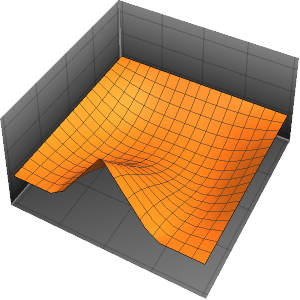

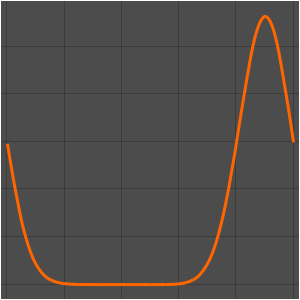

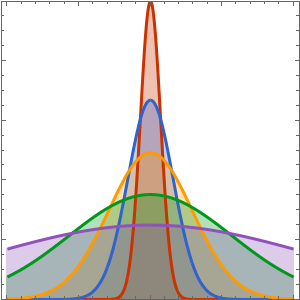

In[3]:=

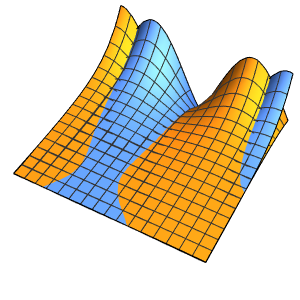

dsol /. {t -> 0, s -> 100, k -> 100, \[Sigma] -> 0.2, T -> 1,

r -> 0.06}Out[3]=

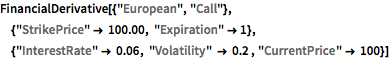

Compare with the value given by FinancialDerivative.

In[4]:=

FinancialDerivative[{"European", "Call"}, {"StrikePrice" -> 100.00,

"Expiration" -> 1}, {"InterestRate" -> 0.06, "Volatility" -> 0.2 ,

"CurrentPrice" -> 100}]Out[4]=