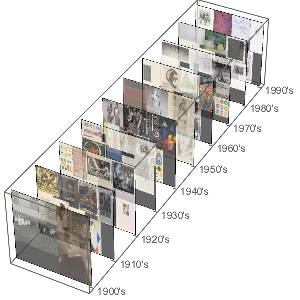

美国联邦存款保险公司组织数据

美国联邦存款保险公司(FDIC)是一个管理美国金融机构存款的独立美国政府机构. 目前,加盟机构的存款有最高 $250,000 的保险. 在此,对加盟机构的资产、大小分布和地理分散进行了研究.

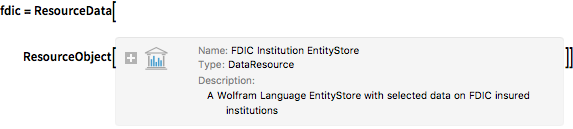

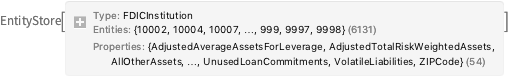

首先, 加载作为 ResourceObject 的 FDIC 数据实体库.

In[1]:=

fdic = ResourceData[

ResourceObject[

Association[

"Name" -> "FDIC Institution EntityStore",

"UUID" -> "6f5d37d4-1406-483c-b67c-f58d903d16b1",

"ResourceType" -> "DataResource", "Version" -> "1.0.0",

"Description" -> "A Wolfram Language EntityStore with selected \

data on FDIC insured institutions",

"ContentSize" -> Quantity[0, "Bytes"],

"ContentElements" -> {"EntityStore"}]]]Out[1]=

注册该部分数据库.

In[2]:=

PrependTo[$EntityStores, fdic];计算 FDIC 机构数目.

In[3]:=

Length[ents = EntityList["FDICInstitution"]]Out[3]=

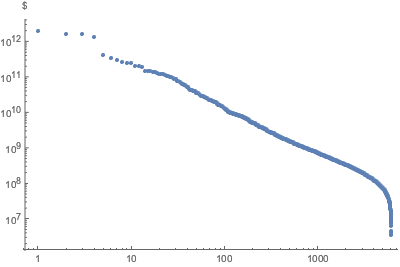

列举实体库中可用的属性.

In[4]:=

EntityProperties["FDICInstitution"] // Sort // Take[#, 20] &Out[4]=

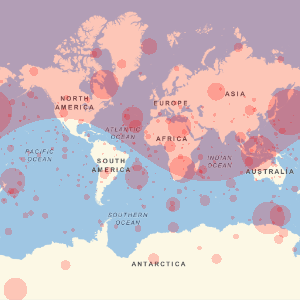

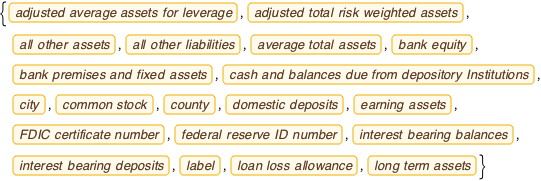

可视化 FDIC 相关银行的地理位置.

In[5]:=

GeoListPlot[EntityList["FDICInstitution"], PlotMarkers -> "$"]Out[5]=

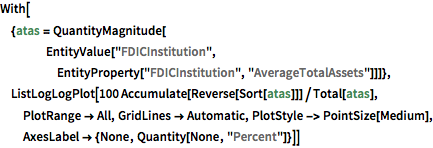

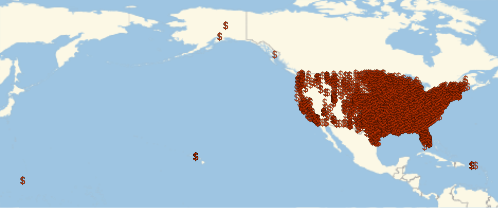

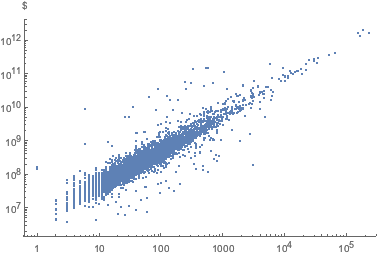

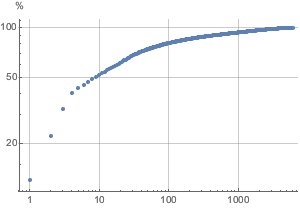

在对数-对数图中显示排名分布.

In[6]:=

ListLogLogPlot[

Reverse@Sort[EntityValue["FDICInstitution", "TotalAssets"]],

AxesLabel -> Automatic, PlotStyle -> PointSize[Medium]]Out[6]=

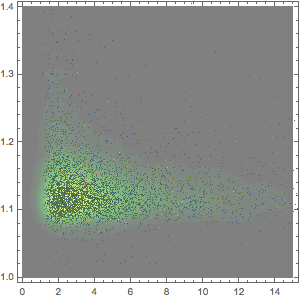

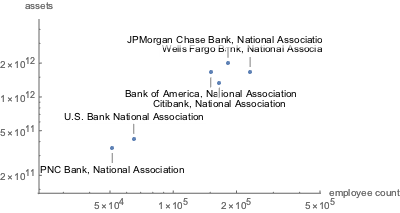

职员与资产绘图.

In[7]:=

empVsAssets =

EntityValue[

"FDICInstitution", {"TotalEmployeeNumber", "TotalAssets"}];In[8]:=

ListLogLogPlot[empVsAssets, AxesLabel -> Automatic]Out[8]=

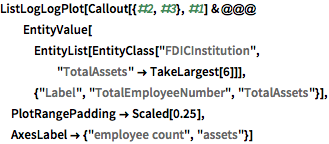

标注最大的六个机构.

显示完整的 Wolfram 语言输入

Out[9]=

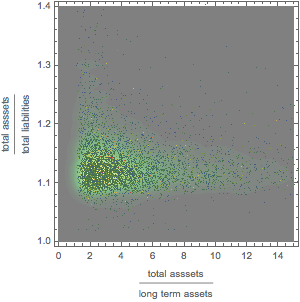

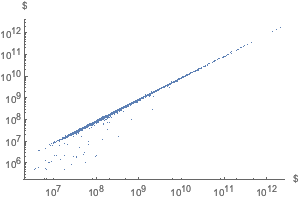

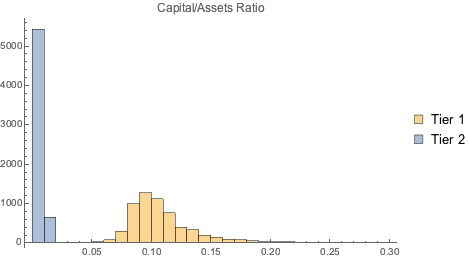

债务与资产绘图.

In[10]:=

assetsVsLiability =

EntityValue["FDICInstitution", {"TotalAssets", "TotalLiabilities"}];In[11]:=

ListLogLogPlot[assetsVsLiability, AxesLabel -> Automatic]Out[11]=

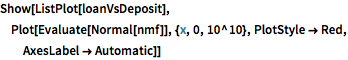

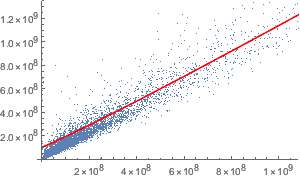

将贷款净额和租赁相对各项存款连同一同拟合绘图.

In[12]:=

loanVsDeposit =

EntityValue[

"FDICInstitution", {"NetLoansAndLeases", "TotalDeposits"}];In[13]:=

nmf = NonlinearModelFit[

Select[QuantityMagnitude /@ loanVsDeposit, Min[#] > 0 &],

c + a x^\[Alpha], {a, \[Alpha], c}, x]Out[13]=

In[14]:=

Show[ListPlot[loanVsDeposit],

Plot[Evaluate[Normal[nmf]], {x, 0, 10^10}, PlotStyle -> Red,

AxesLabel -> Automatic]]Out[14]=

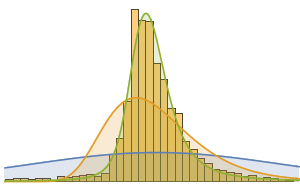

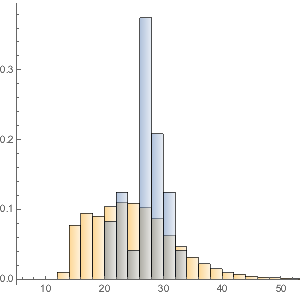

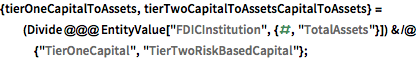

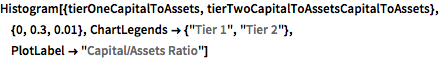

将等级 1(安全)和等级 2(高风险)资产与总资产相对比.

In[15]:=

{tierOneCapitalToAssets,

tierTwoCapitalToAssetsCapitalToAssets} = (Divide @@@

EntityValue[

"FDICInstitution", {#, "TotalAssets"}]) & /@ {"TierOneCapital",

"TierTwoRiskBasedCapital"};In[16]:=

Histogram[{tierOneCapitalToAssets,

tierTwoCapitalToAssetsCapitalToAssets}, {0, 0.3, 0.01},

ChartLegends -> {"Tier 1", "Tier 2"},

PlotLabel -> "Capital/Assets Ratio"]Out[16]=

提取资产分布作为 "EntityAssociation".

In[17]:=

dat = EntityValue["FDICInstitution", "TotalAssets",

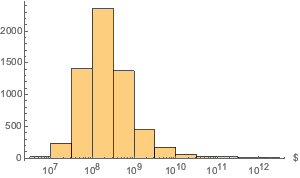

"EntityAssociation"];资产分布的绘图.

In[18]:=

Histogram[dat, "Log", AxesLabel -> Automatic]Out[18]=

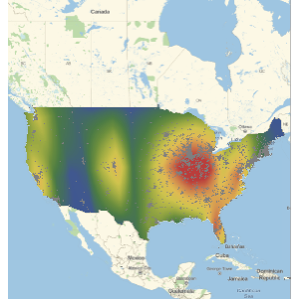

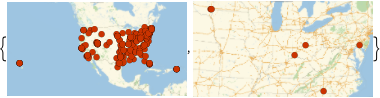

显示资产超过 50 到 3000 亿美金的银行地址.

In[19]:=

GeoListPlot[

Keys[Select[dat,

GreaterThan[Quantity[#, "USDollars"]]]]] & /@ {5*^9, 300*^9}Out[19]=

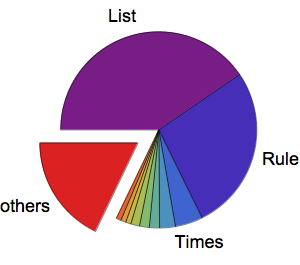

用图形显示所持资产超过其余 6121 家银行总和的前 10 家银行.

显示完整的 Wolfram 语言输入

Out[20]=

找出拥有最高存储的 1% 的银行.

In[21]:=

dat1 = EntityValue["FDICInstitution", "TotalDeposits",

"EntityAssociation"];In[22]:=

{bottom1percent, top1percent} =

Quantile[values = Values[dat1], {0.01, 0.99}]Out[22]=

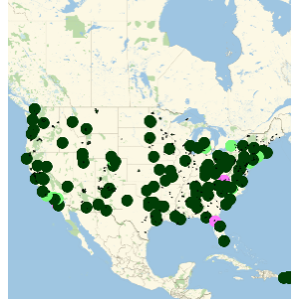

将其绘制在地图上.

In[23]:=

GeoListPlot[Keys[Select[dat1, GreaterThan[top1percent]]]]Out[23]=

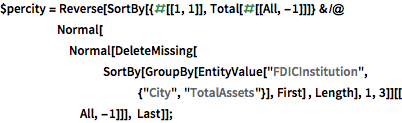

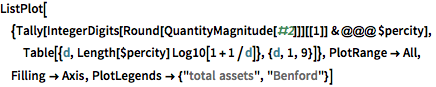

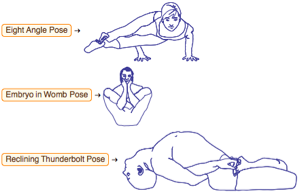

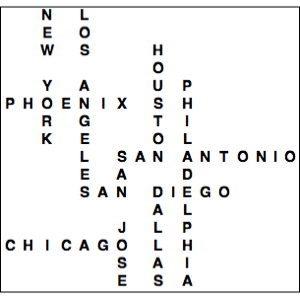

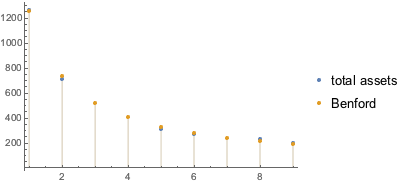

每个城市的资产分布和本福特(Benford)定律有着显著程度的一致.

显示完整的 Wolfram 语言输入

Out[25]=

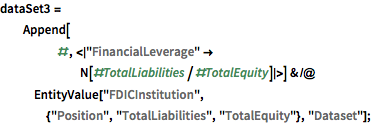

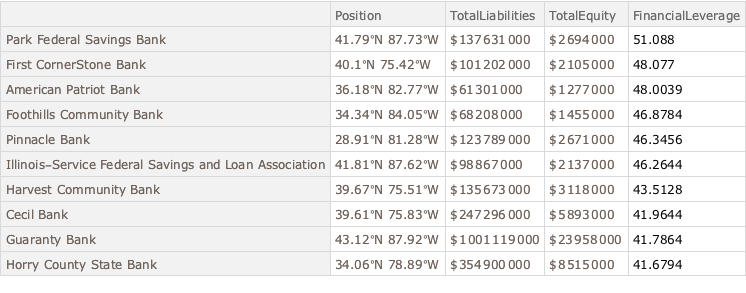

显示拥有最高财务杠杆的银行.

显示完整的 Wolfram 语言输入

In[27]:=

dataSet3[TakeLargestBy["FinancialLeverage", 10]]Out[27]=

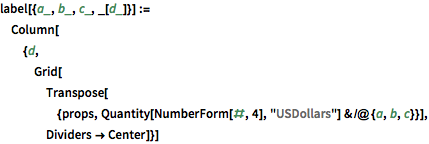

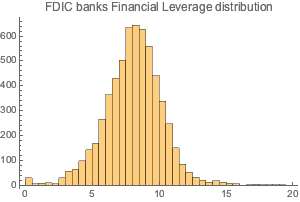

绘制财务杠杆分布图.

In[28]:=

Histogram[dataSet3[All, "FinancialLeverage"], {0, 20, 0.5},

PlotLabel -> "FDIC banks Financial Leverage distribution"]Out[28]=

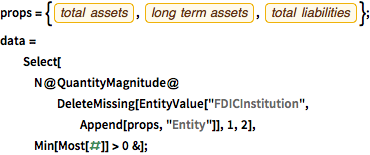

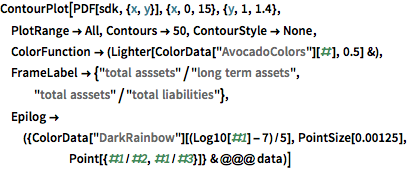

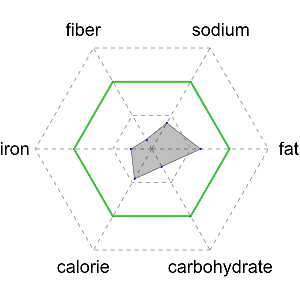

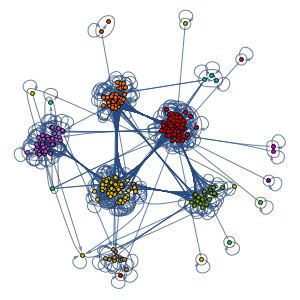

通过图形研究资产、长期资产和负债的关系.

显示完整的 Wolfram 语言输入

Out[33]=