All Classes and Courses

Browse the catalog for self-paced interactive courses, video lessons and video courses, as well as scheduled instructor-led sessions, study groups, webinars and special events.

Click any button to browse all catalog resources in a particular area or use the filters to refine your search. Learn about the different course types.

Introduction to Decision Process Theory

An Overview of Blockchain Design

Blockchain Foundations

Business Analytics and Research with the Wolfram Language

Computational Economics

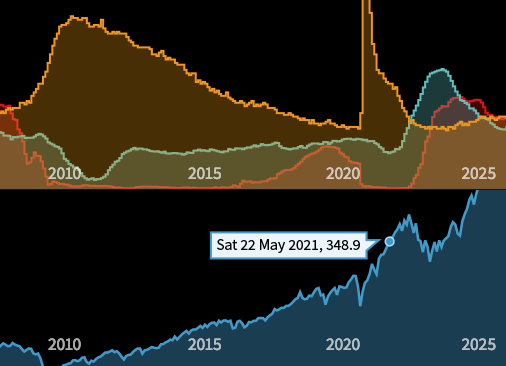

Equity Trading Signal, US Banking Sector: An Event-Driven Strategy

Exploring Blockchain Functionality

(Study Group Sessions)

Exploring Creative Data Analytics

Financial Statistics

Financial Time Series Processing

Interacting with Blockchains

Introduction to Cryptography

Introduction to Stochastic Processes for Finance Research and Trading

Introductory Concepts of Blockchain Mining

Modeling Market Prices Using Stochastic Processes

Optimization of Portfolios and Investments

Portfolio Diversification with Graph Theory

Quantum Algorithms for Real-World Applications

Random Processes in Finance

Time Value of Money

Course Type

- Interactive Courses

- Video Lessons

- Video Courses

- Instructor-led Courses

- Archived and Special Events

Interactive Courses

Also known as MOOCs (massive open online courses), these courses are hosted on the Wolfram Cloud and allow you to interactively explore concepts using Wolfram Language functionality.

Self-paced with progress tracking

Include video lessons, exercises and problems, quizzes, exams and a scratch notebook

Sharable completion certificates available for all courses

Wolfram Level 1 proficiency certifications available for select courses

Video Lessons

Short recorded lessons that provide limited instruction on a computational topic or for using Wolfram tech.

Quick-start videos

Lessons from content experts

A wide variety of beginner-level lessons

Free to watch

Video Courses

Video series that build on preceding lessons to provide comprehensive instruction.

Each video course features a playlist of sequential lessons

Recorded by Wolfram certified instructors

Comprehensive coverage of a particular topic

Free to watch

Instructor-led Courses

Scheduled as online and in-person classes, these courses provide comprehensive instruction guided by a live instructor.

Registration required to reserve your seat

Taught by Wolfram certified instructors

Opportunity to pose live questions to experts in the room

Course completion certificates available

Archived and Special Events

Presentations by Wolfram developers, content experts and instructors.

Webinars on special topics and new release functionality

Livecoding sessions

Wolfram Daily Study Groups

Free to watch